Objective

We have developed Strategical Banking and Academics Inclusion Process to uplift the capacity of educational institutes. To create an impact on traditional educational system by innovating the alignment of R&D Institute, Implementation Institute, Industry and Bank together to impose the impact. The purpose of this process is to acquire your students for the same and prepare them for strategic and senior management.

Hire and train model

-

AFIML ORGANIZATION

AFIML AS AN ORGANIZATION TO ALIGN INDUSTRY

-

AIMS A R&D INSTITUTE

AIMS A R&D INSTITUTE TO CONCEPTUALIZTRAINNING CONTENT, TRANING DELIVER & EVALUATION AND TECHNOLOGY TO IMPLEMENT CONCEPT.

-

SSD, FINANCIAL INSTITUTE

SSD, FINANCIAL INSTITUTE TO MATCH WITH ALL FINANCIAL REQUIREMENTS OF MODEL.

Portfolio of AFIML

Strategic Ventures : 42+ Banks

Total Portfolio Developed : 650+ Cr

Customer Base : 2.5Lac

Employees : 735

Branches : 127

Operations : Maharashtra and UP

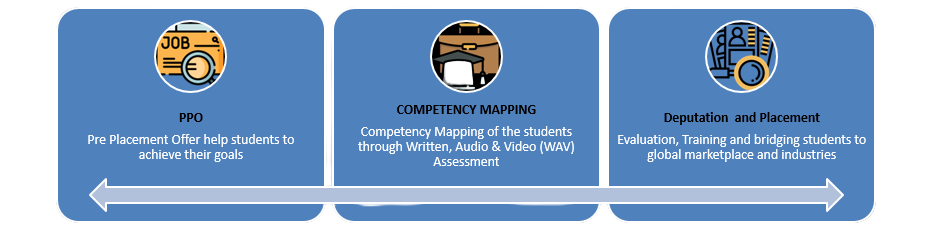

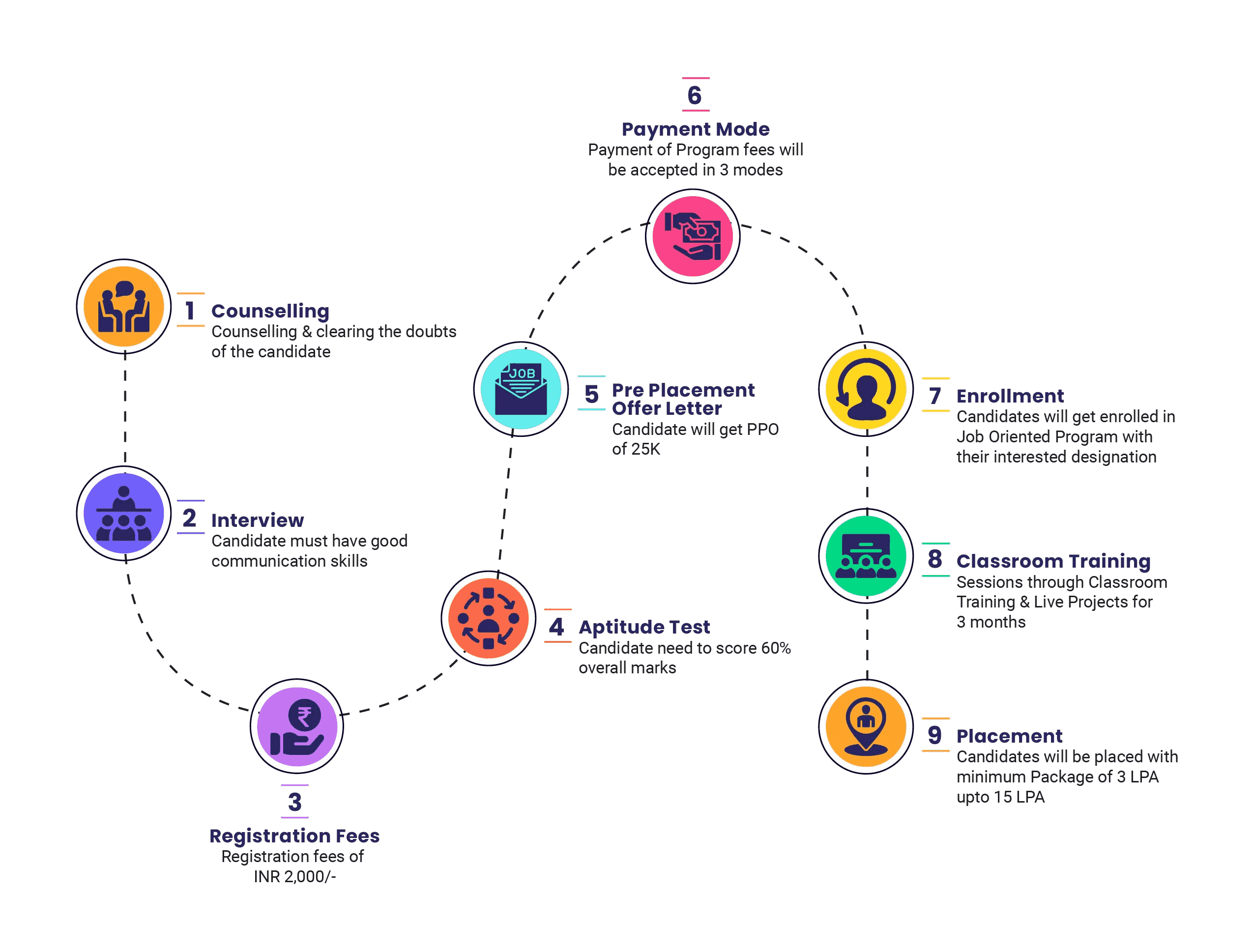

Student Admission Process

Career in Microfinance & Banking

To start a career in banking and finance, one must have an established knowledge of banking and related subjects along with good communication skills, problem-solving capabilities, numeric powers, and time management skills. If you are a fresher, belonging to a non-commerce-oriented background looking to start a career in banking and finance, you can gain the required knowledge from us wide range of courses on the subject.

Area to Explore

Investment Banking

Mobile app development is a process for building mobile applications that run on mobile devices.

Corporate Finance

Web development is the entire process of developing a website for your business on the internet or the intranet.

Equity Research

Digital marketing services are professional services that help market or advertise your business online, like through search, social media, and paid channels.

Project Finance

Business development is the creation of long-term value for an organization from customers, markets, and relationships.

Commercial Banking

Lead generation is the process of attracting prospects and converting them into someone who has an interest in your products and services.

Credit Analyst

Lead generation is the process of attracting prospects and converting them into someone who has an interest in your products and services.

Wealth Management

Business development is the creation of long-term value for an organization from customers, markets, and relationships.

Risk Management

Lead generation is the process of attracting prospects and converting them into someone who has an interest in your products and services.

Content Of Microfinance And Banking

Module 2

1. Survey

2. Branding

3. Branding script

4.Collection

5.Consulting

Module 3

1. Group and center formation

2. Member minimum eligibility criteria for group and center formation

3. Group related policies

Module 4

1. GRT - Group Recognition Test

2. House Verification

3.BLC Branch Loan Committee

Reap The Benefits

Here are the benefits of association :-

AIMS allows every stakeholder to be part of the AIMS Ecosystem to

AIMS allows every stakeholder to be part of the AIMS Ecosystem to

ensure Opportunities for growth during challenging times.

Earn Rs 100,000 to 500,000 Every-month.

Earn Rs 100,000 to 500,000 Every-month.

Digital marketing support for better visibility on various public platforms

Digital marketing support for better visibility on various public platforms

Technology, Print Material, Training & Process will also be provided by AIMS.

Technology, Print Material, Training & Process will also be provided by AIMS.

Do Business with Us

“We provide fintech software development services to optimize financial practices to provide operational efficiency, data security, reduce processing time, & maximize ROI. Our data-driven Banking & financial solutions offer in-depth Insights to Help You make better business-critical decisions”